Key Points

- Quarterly-filed 13Fs provide investors with a way to track which stocks Wall Street’s most-prominent money managers are buying and selling.

- Citadel’s hedge fund, which is the most-profitable of all hedge funds since its inception, was a noted seller of Palantir common stock during the third quarter.

- However, Griffin oversaw a 194% increase in the number of common shares held in this backbone of the AI revolution.

- 10 stocks we like better than Palantir Technologies

Griffin’s Citadel hedge fund made some big moves in the artificial intelligence (AI) arena during the September-ended quarter.

This has been a busy month on the news front for Wall Street. Between Election Day, earnings season, and the October inflation report, investors haven’t been hurting for catalysts. But among these various data releases, you might have missed what’s arguably the most important of them all — the Nov. 14 deadline to file Form 13F with the Securities and Exchange Commission for the September-ended quarter.

A 13F is a required filing no later than 45 calendar days following the end to a quarter for institutional investors with at least $100 million in assets under management. These filings offer investors a concise snapshot of which stocks Wall Street’s most-famous money managers have been buying and selling.

Although investors eagerly wait for the curtain to lift on Warren Buffett’s trading activity at Berkshire Hathaway, he’s far from the only billionaire who’s overseen big-time returns on Wall Street. For instance, investors also tend to pay close attention to Ken Griffin at Citadel, who oversees the most-profitable hedge fund since inception.

Citadel operates an active fund that almost always hedges its common-stock position with put and call options, and may have other positions (short positions, as well as options held short) that don’t show up in a 13F filing.

But among the countless trades made by Griffin’s hedge fund during the third quarter, two stand out.

Griffin’s Citadel sent almost the entirety of its stake in Palantir to the chopping block

Arguably one of the hottest artificial intelligence (AI) stocks on the planet right now is cloud data-mining specialist Palantir Technologies (PLTR -1.58%). Shares of Palantir have skyrocketed by 791% on a trailing-two-year basis, as of this writing on Nov. 23, with the company’s market cap briefly tipping the scales at $150 billion last week.

Yet in spite of these otherworldly gains, billionaire Ken Griffin disposed of 91% of the Palantir common shares Citadel’s hedge fund held during the September-ended quarter. There were also corresponding increases in put and call options held by Citadel for Palantir, which hedges against its common-stock position.

Before digging into the catalysts that might coerce a billionaire money manager and their team to sell shares of Palantir, it’s important to first understand the bull thesis.

The wind in Palantir’s sails is its irreplaceability at scale. The company’s AI-inspired Gotham platform is used by federal governments to plan and execute missions, as well as gather copious amounts of data. Meanwhile, its AI- and machine learning-powered Foundry platform helps businesses make sense of their data. No other company comes close to offering the breadth of services that Palantir can, which leads to highly predictable operating cash flow quarter after quarter.

The other catalyst for Palantir Technologies is its push to recurring profitability. Businesses with sustainable moats that demonstrate their ability to generate a profit are often rewarded with a hearty valuation premium by investors.

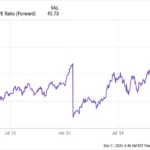

On the flipside, valuation might be the biggest reason Ken Griffin, along with other billionaire money managers, sent shares of Palantir packing in the third quarter. As of the closing bell on Nov. 22, shares of the company were valued at more than 42 times Wall Street’s consensus sales forecast for 2025, as well as 137 times projected earnings per share (EPS). Both levels are consistent with bubble-like valuations that won’t be sustainable over the long run.

Additionally, since Gotham can only be used by the U.S. government and its allies, there’s a somewhat limited long-term opportunity for Palantir’s core profit-driving operating segment. Although Foundry is growing like a weed, it’s not yet the proven operating platform that Gotham is.

More than likely, Palantir’s near-parabolic increase in its share price won’t be sustainable.

Griffin is suddenly piling into the backbone of the AI revolution

Perhaps even more surprising than Griffin overseeing the sale of most of his hedge fund’s common-stock stake in Palantir Technologies was witnessing he and his team reverse course on Wall Street’s artificial intelligence darling Nvidia (NVDA -3.49%) during the September-ended quarter.

After being a decisive seller of Nvidia stock during the second quarter, which is when Nvidia conducted its historic 10-for-1 stock split, Citadel’s hedge fund increased its holdings in this AI colossus by 194% during the third quarter. Once again, this increase occurred as Citadel’s put and call option positions in Nvidia were reduced, which demonstrates the ongoing hedges Griffin’s fund has in place.

The reason institutional investors and billionaire asset managers have piled into Nvidia is very simple: its unmistakable dominance in AI-accelerated data centers.

Nvidia’s graphics processing units (GPUs) accounted for an estimated 98% of shipments to data centers in 2022 and 2023, per TechInsights, and orders for its H100 GPU (commonly known as the “Hopper” chip) and Blackwell GPU are currently backlogged. Nvidia’s hardware is the preferred option as the brains that power split-second decision-making for high-compute data centers.

To add to the above, Nvidia’s pricing power and gross margin are undeniably benefiting from enterprise demand swamping supply. When the demand for a good outpaces supply, the law of supply and demand states the price of that good will rise until demand tapers. Nvidia has been netting $30,000 to $40,000 for its Hopper chip, which is double to quadruple the price point of Advanced Micro Devices Insight MI300X AI-GPU.

It should also be noted that no other company appears to be particularly close to challenging the computing capabilities of Nvidia’s GPUs. While competing chips may offer subtle advantages with select tasks, or perhaps be more energy efficient, they continue to play second fiddle to the computing potential of Nvidia’s hardware.

But there’s another side to the Nvidia story that Griffin and other optimistic billionaire money managers may be overlooking. For example, competitive pressures are beginning to crop up, as evidenced by the sudden gross margin decline Nvidia is contending with.

AI-GPU scarcity has played a critical role in boosting Nvidia’s pricing power and its gross margin. However, many of Nvidia’s top customers by net sales are internally developing AI-GPUs of their own. Even though these chips aren’t superior to Nvidia’s hardware, they’re cheaper and more easily accessible. When combined with AMD and other external rivals ramping production of their AI-GPUs, it’s easy to see how Nvidia’s pricing power and margins could wane in the coming quarters.

Nvidia is also contending with history, which has been anything but an ally of game-changing innovations over the last three decades. For 30 years, investors have consistently overestimated the early stage utility and adoption of new technologies and innovations, which has eventually led to a bubble-bursting event. There’s nothing that suggests AI or Nvidia is going to be the exception.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,060!*

Now, it’s worth noting Stock Advisor’s total average return is 896% — a market-crushing outperformance compared to 176% for the S&P 500.

Don’t let others invest while you stand on the sidelines.