With Bitcoin approaching $100,000 as we go to press, many of your clients may ask if they should add cryptocurrency to their portfolios. Some may be irked that they’ve been sitting on the sidelines for so long while cryptocurrencies such as Bitcoin have gained over 100% this year (over 30% since the presidential election) and about 1,100% over the past five years. Some may be curious about these digital tokens and where they fit into their overall financial plan (if at all).

Initially, I was very curious about cryptocurrency and more than a bit skeptical about its value. But as I’ve done more research, I’m now convinced Bitcoin is one of the currencies that’s here to stay and, in many ways, just as good a store of value as gold – maybe better.

At its core, Bitcoin is one of nearly 9,000 active cryptocurrencies. However, it’s fairly unique in that it’s decentralized and has a fixed supply. Bitcoin is often compared to gold due to its limited availability (only 21 million bitcoins will ever exist) and perceived store of value. What are other stores of value? Real estate, the stock market, banks, holding debt. What are the risks associated with these holdings? Unlike gold and silver, crypto has no industrial purpose to the best of my knowledge.

So, why is Bitcoin at record levels today? Quite simply, it has to do with the laws of supply and demand. Again, only 21 million coins are available, and there won’t be more. Buyers are competing for the limited supply and driving up the price as they try to capture more coins. As Bitcoin becomes more accepted as a store of value, investors rely on it as a safe haven from inflation and deflation. That’s because they don’t believe governments can destroy Bitcoin’s value through excess borrowing like they can with the U.S. dollar. It hasn’t hurt that the incoming Trump administration seems pro-crypto and favors less government regulation.

Likelihood of Another Crash

From November 2021 through November 2022, Bitcoin sank about 75% from a record high of over $64,000 to roughly $16,000 when rising interest rates and reduced liquidity in the financial markets hammed its price. You may remember that 2022 was a terrible year for stocks and bonds, too, but the declines were closer to 19% and 13%, respectively, not 75%. However, there have been plenty of instances in which Bitcoin has soared when stocks and bonds languished, and vice versa. I’ve seen no evidence Bitcoin or other cryptocurrencies are correlated with U.S. stocks or bonds (more on that in a minute).

Adding to Clients’ Portfolios

Every client’s situation is unique, but there are three important issues to consider when deciding whether to add crypto to a client’s portfolio:

1. Which crypto? Issues like market, supply, volatility and liquidity are all important considerations. Not all cryptos are equal, and as stated above, there are nearly 9,000 active cryptocurrencies to choose from. If clients want to hold crypto, shouldn’t you help them find the one most likely to survive over the long run?

2. Diversification. Crypto can play a part in a client’s overall portfolio diversification; more on that in a minute. Consider a mix of mining, outright ownership on a crypto exchange, and crypto ETFs within the crypto bucket. The recent introduction of crypto ETFs has made it much easier for individual investors to hold the coins, and some hedging ETFs even pay dividends.

3. Risk temperament. There are no guarantees that crypto will continue to hold value. Advisors need to address the possibility of total loss and how a client would handle that outcome should it happen.

Tax Implications

The taxes on your clients’ crypto holdings will depend on how the gains were acquired. If the coins were acquired firsthand through digital “mining,” then the value at the time of acquisition is treated as ordinary income, and there’s no basis. But if they continue to hold them, any appreciation is a long-term gain. Many investors and some advisors have overlooked this fact. If an investor purchases coins and sells them later for a gain, the tax is capital gains based on the appreciation over basis, just as with stocks and bonds. Also, remember that if a client’s (NII) from capital gains, interest, dividends and any income from cryptocurrency investments exceeds $250,000 (MFJ) or $200,000 (single), they’ll likely have to pay the 3.8% NII tax.

Risks

In addition to regulatory risk from various governments, the real risk of holding crypto arises when a market for the coins no longer exists. This could happen due to fraud, economic catastrophe, competition or just a loss of interest. Investors must understand crypto is a perceived value. As long as that value is perceived, it exists. Once the perception of value is extinguished, the value disappears and may become zero. But the same can be said of NVIDIA, Microsoft and any other publicly traded stock.

Volatility

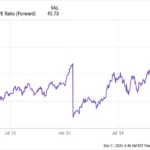

When deciding where cryptocurrency fits into a client’s overall portfolio, many advisors try to assign a volatility measure to it, such as beta. A recent report based on Bloomberg data said Bitcoin was likely to move four to five times when compared to the S&P 500. But since crypto hasn’t consistently correlated with any market, it can’t be defined as a “beta.” However, because unforeseen events (for example, wars, flash crashes and bubbles) can have a detrimental impact on markets, such events will also impact crypto if holders expect the unforeseen event will negatively impact the liquidity and viability of the crypto.

Liquidity

Because Bitcoin is still in its infancy, there’s no real marketplace other than self-designated markets. The risk of being unable to sell Bitcoin in a crisis is still unresolved. This is where demand and perception play a major part in determining value. An example was the stock market crash of 2008, when it was nearly impossible to get any of the main trading platforms on the phone because of the panic. The bottom line is that if a client wants to own crypto, they should make sure they won’t have significant liquidity needs in the event of a sharp correction or global crisis.

Hedging Tool?

Many advisors wonder if crypto can be used to hedge clients’ positions in stocks, bonds, real estate, gold or even cash. Again, there doesn’t seem to be any statistical correlation between crypto and other traditional assets. I’ve found that the best way to invest in crypto is to spread the risk among actual ownership of the coins, exchange-traded funds (ETFs), and miners. But be prepared for a wild ride. Many crypto ETFs are available now that the Securities and Exchange Commission has opened that door. There’s no reason to think the ETFs will be less volatile than holding crypto directly. The advantage is the ease of liquidation.

Recommended Allocation

Holding crypto is a risk tolerance question: to what degree can a client tolerate the prospect of seeing their entire investment evaporate? Setting expectations is crucial. Only a small percentage of our clients meet our risk tolerance criteria. When they do, we advise them to allocate no more than 3% to 5% of their portfolio to crypto – about the same as we advise for their emergency cash allocation

My personal experience with crypto has been very choppy. I started with miners and held several different ones. After the halving (when the value of mining a coin was cut in half), I consolidated into just one miner. I was fortunate to earn a 10 times return on one of my early purchases of miners. When I sold, I took back my capital and continued to invest the profit. I’ve seen that profit nearly disappear and then bounce back to a 10 times gain. There have been some wild swings in the value. I’m back to my 10 times-plus with the recent run-up in crypto values. But for many months, my account was in a severe negative position. I’ve also purchased a crypto ETF and recently used call options to generate cash premiums paid as dividends. My son, who works at our firm, had a similar experience. In July, his crypto holdings peaked. In September, they had been cut in half, but by early November, his holdings made everything back plus an additional 20% from their July 2024 all-time highs.

Legitimate Store of Value

Make sure clients go into crypto with their eyes open, don’t have short-term liquidity needs and have reliable safeguards in place. But unlike adrenaline sports and gambling, I believe crypto is a legitimate store of value. It’s a place to park money and keep pace with inflation because it won’t move in lockstep with the dollar; it won’t be deflated when the Fed injects additional dollars into the economy. You owe it to yourself and your clients to keep abreast of crypto developments as crypto becomes increasingly mainstream. It does represent change, but it’s worth the risk.