The Dow Jones Industrial Average, S&P 500 and the Nasdaq headed lower in afternoon trades in the stock market today. Broadcom (AVGO) soared on a bullish AI outlook after results met Wall Street estimates. Nvidia (NVDA) fell but Tesla (TSLA) headed higher.

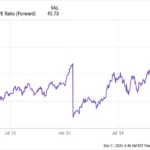

Broadcom stock cleared the $1 trillion market cap milestone, while Nvidia broke below the 50 day moving average. Broadcom is on IBD Tech Leaders. Nvidia is on IBD Leaderboard. Both are on AI stocks to watch.

Tesla rose even after famed investor Cathie Wood sold about $15 million of the stock from the ARK Innovation ETF (ARKK), according to the firm’s documents. Tesla has rallied over 65% since shares gapped up on Nov. 6.

Dow Jones industrials fell 0.1% as it extended a pullback from the Dec. 4 all-time high. The Nasdaq and the S&P 500 reversed lower 0.1% each. But AI stocks Marvell Technology (MRVL) and Arm Holdings (ARM) gained.

Moderna (MRNA) and Super Micro Computer (SMCI) fell 2% and 5%, respectively. Both stocks may exit the Nasdaq 100 with Friday’s index rebalancing. Palantir (PLTR) and massive bitcoin holder MicroStrategy (MSTR) may become the newest adds to the index.

Palantir, MicroStrategy In Focus

Palantir has rallied over 70% since shares gapped up on Nov. 5 after third quarter results. The stock is above the 10-day moving average. MicroStrategy has pulled back to the 21-day moving average.

Small caps fared poorly, with the Russell 2000 down 0.9%. The index is down 2.7% for the week.

Volume on the NYSE and Nasdaq exchanges was lower compared with the same time Thursday, more so on the Nasdaq.

Stock market breadth remained negative, with losers beating winners on both exchanges by more than 2-to-1.

The Innovator IBD 50 ETF (FFTY) bucked the broader malaise and traded 0.6% higher Friday afternoon. Dave (DAVE), Rocket Lab (RKLB), Celestica (CLS) and Astera Labs (ALAB) gave the ETF much of its lift.

The yield on the benchmark 10-year Treasury note rose seven basis points to 4.39%.

Treasury Yield Hurts Small Caps

The 10-year Treasury yield is up nearly 25 basis points so far this week — one reason why small caps have started to lag — ahead of next week’s Federal Reserve meeting. The two-day meeting concludes Wednesday with the policy statement due at 2 p.m. ET. The Fed is widely expected to cut its key lending rate by another 25 basis points to a range of 4.25% to 4.5%.

Inside the MarketSurge Growth 250, Taiwan Semiconductor (TSM) crossed the 200 level early and got closer to a 205.63 buy point. TSMC pared early gains but was still up 4%.

Inside the medical products group, small-cap LeMaitre Vascular (LMAT) is getting support at its 10-week moving average for the first time after an earnings breakout in early November.

Stock Market Today: Broadcom Rallies

The Nasdaq composite on Thursday suffered its second distribution day this week, falling 0.7% in higher volume. The first one was on Monday, when the index fell 0.6%, also in higher volume. It’s important to keep tabs on distribution days on the Nasdaq and S&P 500. When they start to cluster, it almost always causes problems for a stock market uptrend.

Stocks held decent gains during the first half-hour of trading as the Nasdaq composite moved above the 20,000 level again to an all-time high.

Broadcom reported fiscal Q4 earnings and revenue that were mostly in line with expectations. But growth accelerated for the second straight quarter, and investors liked news that full-year AI revenue more than tripled to $12.2 billion. CEO Hock Tan also said the company is developing custom AI chips with three large cloud customers.

Broadcom scored a chart breakout Friday, gapping out of a double-bottom base with a 185.05 entry. Its market capitalization topped $1 trillion for the first time.

Earnings reports in the retail sector were also in focus. Leaderboard stock Costco (COST) rallied after earnings topped expectations and revenue came in mostly in line with expectations. Membership fees totaled $1.17 billion, up 8% year over year. E-commerce sales increased 13%.

RH (RH), formerly known as Restoration Hardware, surged nearly 14% after the company reversed a year-ago loss with adjusted profit of $2.48 a share. Revenue increased 8% to $811.7 million even though CEO Gary Friedman cited a weak housing market.

Investors liked full-year revenue guidance of 6.8% to 7.2%, up slightly from prior guidance of 5% to 7%. Note that some of RH’s move today could be due to short covering. Headed into Friday, about 14% of RH’s tiny float of 13 million shares was held short.