Bitcoin supply profitability should form a focus for those seeking to avoid the return of the BTC bear market, CryptoQuant said.

Bitcoin hodlers should start selling BTC “aggressively” once realized profits reach a key milestone, analysis says.

In one of its Quicktake blog posts on Dec. 13, onchain analytics platform CryptoQuant told readers to watch the portion of the Bitcoin BTC$101,412 supply “in loss.”

BTC supply in loss can drop 50% before sell signal

Bitcoin bull markets have a habit of ending when supply profitability crosses a certain threshold, CryptoQuant said.

Reviewing the last bull market, which reversed in late 2021, contributor Onchain Edge said that supply profitability signals were in place for many months.

“When the BTC supply loss % goes below 4% you should start dcaing aggressively out of BTC and wait for the next bear market lows,” according to accompanying commentary.

Onchain Edge was referring to an investment technique called dollar-cost averaging (DCA) — the practice of buying BTC with a set amount of another asset, such as fiat currency, at regular intervals.

To avoid the volatility and subsequent comedown that characterized much of 2021 and to protect profits, February was arguably the time to begin selling BTC via DCA, reducing exposure.

“Why? Below 4% means a lot of people are in a profit this is the peak bullrun phase,” the post continued.

An illustrative chart showed daily moving averages of the current percentage of supply at a loss, which as of Dec. 12 was still circling 8%.

Bitcoin whale profits still modest

As Cointelegraph reported, other market participants are watching profitability levels of certain hodler cohorts for BTC price cues.

Related: Bitcoin bulls ignore PPI shock as whales fuel BTC price run to $102K

In particular, the round numbers $110,000 and $120,000 are upside targets, thanks to the effect that crossing them will have on short-term holders (STHs).

These speculative investors tend to react more suddenly to BTC price moves.

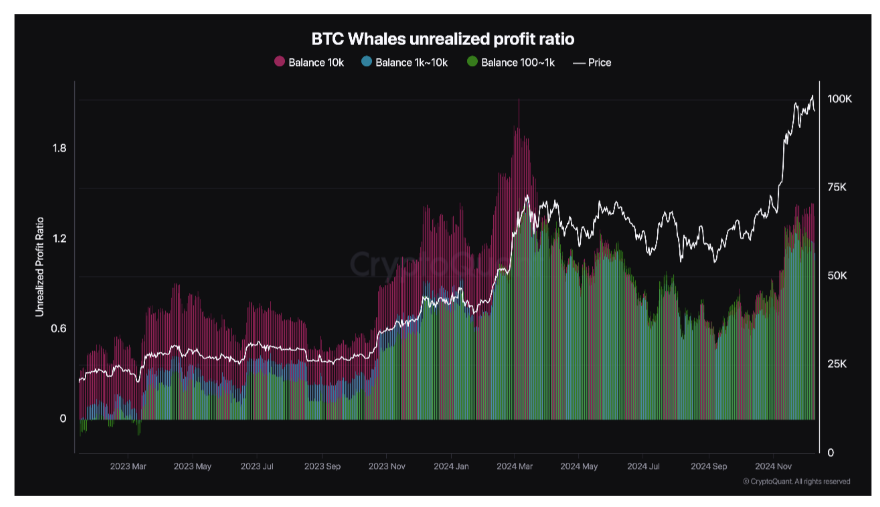

Analyzing unrealized profits among Bitcoin whales, meanwhile, fellow CryptoQuant contributor Darkfost saw little cause for concern.

“If we compare to what happened in March, the unrealized profit ratio almost reached 2 before declining as whales began to take profits and Bitcoin’s price started to fall,” another Quicktake post explained.

“With the unrealized profit ratio currently around 1.2 and Bitcoin priced near 100k, this indicates that there may still be room for the bullish trend to continue in the mid-term.”