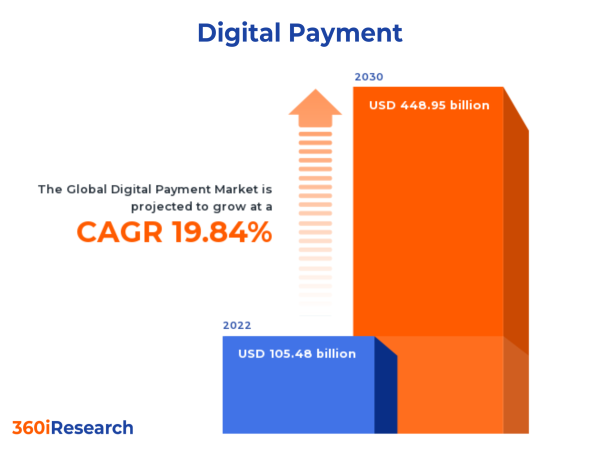

The Global Digital Payment Market to grow from USD 105.48 billion in 2022 to USD 448.95 billion by 2030, at a CAGR of 19.84%. PUNE, MAHARASHTRA, INDIA, November 9, 2023 /EINPresswire.com/ — The “Digital Payment Market by Offering (Services, Solutions), Transaction Type (Cross Border, Domestic), Mode of Payment, Deployment Type, Organization Size, Vertical – Global Forecast 2023-2030” report has been added to 360iResearch.com’s offering. The Global Digital Payment Market to grow from USD 105.48 billion in 2022 to USD 448.95 billion by 2030, at a CAGR of 19.84%. Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/digital-payment?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample Digital payment, or e-payment, is a financial transaction carried out electronically instead of using physical cash or checks. It involves transferring money from one party to another through digital means, facilitated through smartphones, tablets, computers, and wearables. The rapid increase in internet penetration has significantly boosted e-commerce activities worldwide. Moreover, the proliferation of smartphones has provided users with easy access to digital payment platforms. However, data privacy concerns may adversely impact the use of digital payment by the end-users. Besides, technological advancements and changing consumer preferences for convenience and security are expected to encourage the adoption of digital payments by the end-use sectors worldwide. Transaction Type: Expanding the use of digital payments for cross-border transactions Cross-border digital payments facilitate transactions between parties located in different countries or jurisdictions. Consumers and businesses prefer cross-border digital payments when they require seamless currency conversion, reduced transaction costs compared to traditional banks, real-time tracking of transactions, and multi-factor authentication. Domestic digital payments encompass transactions occurring within the geographical boundaries of a single country or jurisdiction. These can include person-to-person (P2P) transfers, business-to-business (B2B) payments, bill payments, and mobile wallets. Domestic digital payments generally have simpler regulatory requirements than cross-border transactions, as they do not involve multiple jurisdictions or currency conversions. Additionally, domestic digital payment services often offer a more comprehensive range of features tailored to local needs, such as integration with local merchants or government services, including tax payments. Organization Size: Significant adoption of digital payment solutions in large enterprises to streamline financial operations Digital payments enable large organizations and Small and medium-sized Enterprises to boost their efficiency levels significantly. By automating transactions and allowing for seamless integration with accounting systems, businesses can save time on manual reconciliation processes while minimizing human errors. Moreover, digital payment platforms offer real-time settlement options that help companies optimize their cash flow management. Large organizations prioritize security, scalability, and integration capabilities, while SMEs seek simplicity, affordability, and ease of use in their payment solutions. Offering: Significant penetration of Point of Sale (POS) solutions across businesses Digital payment services encompass a range of managed and professional services that facilitate electronic transactions between parties. Digital payment solutions involve software or hardware products that streamline the payment process for merchants or consumers. Point of Sale (POS) systems are essential for brick-and-mortar businesses, as they manage transactions, inventory, and customer data. Payment gateway services are intermediaries between a customer’s bank account and the merchant’s payment processing system. Mobile wallets enable users to store their card information securely on their smartphones for convenient payments in-store or online. Deployment Type: Growing preference for on-cloud digital payment deployment Third-party providers host on-cloud digital payment solutions through the Internet to offer flexibility, scalability, and cost-effectiveness to businesses of all sizes. On-cloud solutions are ideal for small-to-medium-sized businesses (SMBs) that require a flexible payment infrastructure with minimal upfront investment. On-premises digital payment solutions involve installing software directly onto a company’s servers and hardware. This deployment type offers enhanced control, security, and customization for businesses with specific requirements. On-cloud platforms provide flexibility, scalability, and cost-effectiveness, ideal for SMBs with limited budgets and rapidly changing transaction volumes. On the other hand, on-premises solutions provide greater control, security, and customization options for large enterprises or organizations with strict compliance requirements. Vertical: Proliferation use of digital payment in the retail & e-commerce sector The BFSI sector needs secure and efficient digital payment solutions to manage customer transactions. Digital payments are crucial for streamlining billing processes and ensuring timely settlements between insurance companies, healthcare providers, and patients in the healthcare sector. Digital payments significantly provide access to media content on various platforms, including streaming services, gaming, or music subscriptions. Retail & e-commerce demand fast, user-friendly digital payment options to facilitate online shopping experiences. Telecommunication companies require secure digital payment solutions for managing customer subscriptions and billing. Digital payments are essential for transport operators to manage transactions for various transportation services such as ride-hailing, public transit, or parcel delivery. The travel sector relies on digital payment platforms to facilitate bookings, reservations, and other transactions in hotels, airlines, and tourism businesses. Mode of Payment: Proliferation of digital currencies and digital wallets due to their inclusive, secure, and cost-efficient services Bank cards, including credit, debit, and prepaid cards, are a popular digital payment mode and offer a need-based preference for consumers seeking convenience and security in their transactions. Digital wallets allow users to securely store their bank account information or card details on their devices for easy access during online transactions. The growing integration of digital payments with various devices, such as smartphones or wearables, enables seamless online and offline transactions through NFC technology or QR code scanning. Net banking, or online banking, allows users to conduct financial transactions through their bank’s secure website or app. The increased convenience and reduced need for physical visits to bank branches and significant investment in providing user-friendly online platforms for customers have increased the adoption of net banking. Moreover, digital currencies such as cryptocurrencies offer an alternative means of payment with greater decentralization and anonymity. The lower transaction fees compared to traditional banking systems and faster processing times for international transactions have significantly boosted the adoption of digital currencies. Regional Insights: The digital payment market is evolving in the Americas owing to robust infrastructure, high smartphone penetration rates, and increasing adoption of mobile wallets. Financial institutions in the Americas continue investing in fintech initiatives to improve user experience and security features. The European digital payment landscape is characterized by open banking initiatives across the EU and the growth of contactless digital payments. The EMEA region is witnessing rapid growth in digital payments driven by increasing internet penetration rates and an emphasis on developing cashless economies with government-backed digital payment initiatives. The APAC region’s digital payment market is growing due to the rise in QR code-based mobile payments developing financial infrastructure. Moreover, the integration of innovative features and incentives within digital payment platforms is expected to encourage global usage among end-users. FPNV Positioning Matrix: The FPNV Positioning Matrix is essential for assessing the Digital Payment Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V). Market Share Analysis: The Market Share Analysis offers an insightful look at the current state of vendors in the Digital Payment Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied. Key Company Profiles: The report delves into recent significant developments in the Digital Payment Market, highlighting leading vendors and their innovative profiles. These include ACI Worldwide, Inc., Adyen N.V., Apple Inc., Aurus Inc., BharatPe, BitPay Inc., BlueSnap Inc., Cardstream Limited, CCBill, LLC, CryptoBucks by Aliant Payments Inc., Digital Bharat Pay by FACT Fintech India Private Limited, Dwolla, Inc., Finastra, FIS, Inc., Fiserv, Inc., FLEETCOR TECHNOLOGIES, INC., Global Payments Inc., Google LLC by Alphabet Inc., INGENICO, International Business Machines Corporation, Intuit Inc., JPMorgan Chase & Co., Mastercard International Incorporated, MatchMove Pay Pte Ltd., Microsoft Corporation, PayPal Holdings, Inc., Paysafe Limited, Paysend PLC, Paytm by One97 Communications Limited, PayU Payments Private Limited, Ripple Services Inc., Spreedly, Inc., Square, Inc. by Block, Inc., Stax by Fattmerchant, Inc., Stripe, Inc., Temenos Headquarters SA, Visa Inc., WEX Inc., and Worldline S.A.. Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/digital-payment?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire Market Segmentation & Coverage: This research report categorizes the Digital Payment Market in order to forecast the revenues and analyze trends in each of following sub-markets: Based on Offering, market is studied across Services and Solutions. The Services is further studied across Managed Services and Professional Services. The Professional Services is further studied across Consulting, Implementation, and Support & Maintenance. The Solutions is further studied across Payment Gateway Solutions, Payment Processor Solutions, Payment Wallet Solutions, and Point of Sale (POS) Solutions. The Solutions commanded largest market share of 62.12% in 2022, followed by Services. Based on Transaction Type, market is studied across Cross Border and Domestic. The Domestic commanded largest market share of 62.12% in 2022, followed by Cross Border. Based on Mode of Payment, market is studied across Bank Cards, Digital Currencies, Digital Wallets, and Net Banking. The Net Banking commanded largest market share of 39.23% in 2022, followed by Bank Cards. Based on Deployment Type, market is studied across On-Cloud and On-Premises. The On-Cloud commanded largest market share of 90.79% in 2022, followed by On-Premises. Based on Organization Size, market is studied across Large Enterprises and Small & Medium-Sized Enterprises. The Large Enterprises commanded largest market share of 57.88% in 2022, followed by Small & Medium-Sized Enterprises. Based on Vertical, market is studied across Banking, Financial Services, & Insurance, Healthcare, Media & Entertainment, Retail & e-Commerce, Telecommunication, Transportation & Logistics, and Travel & Hospitality. The Banking, Financial Services, & Insurance commanded largest market share of 26.44% in 2022, followed by Retail & e-Commerce. Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 38.49% in 2022, followed by Europe, Middle East & Africa. Key Topics Covered: 1. Preface 2. Research Methodology 3. Executive Summary 4. Market Overview 5. Market Insights 6. Digital Payment Market, by Offering 7. Digital Payment Market, by Transaction Type 8. Digital Payment Market, by Mode of Payment 9. Digital Payment Market, by Deployment Type 10. Digital Payment Market, by Organization Size 11. Digital Payment Market, by Vertical 12. Americas Digital Payment Market 13. Asia-Pacific Digital Payment Market 14. Europe, Middle East & Africa Digital Payment Market 15. Competitive Landscape 16. Competitive Portfolio 17. Appendix The report provides insights on the following pointers: 1. Market Penetration: Provides comprehensive information on the market offered by the key players 2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets 3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments 4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players 5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments The report answers questions such as: 1. What is the market size and forecast of the Digital Payment Market? 2. Which are the products/segments/applications/areas to invest in over the forecast period in the Digital Payment Market? 3. What is the competitive strategic window for opportunities in the Digital Payment Market? 4. What are the technology trends and regulatory frameworks in the Digital Payment Market? 5. What is the market share of the leading vendors in the Digital Payment Market? 6. What modes and strategic moves are considered suitable for entering the Digital Payment Market? Read More @ https://www.360iresearch.com/library/intelligence/digital-payment?utm_source=einpresswire&utm_medium=referral&utm_campaign=analystMr. Ketan Rohom 360iResearch +1 530-264-8485 email us here