To activate the text-to-speech service, please first agree to the privacy policy below.

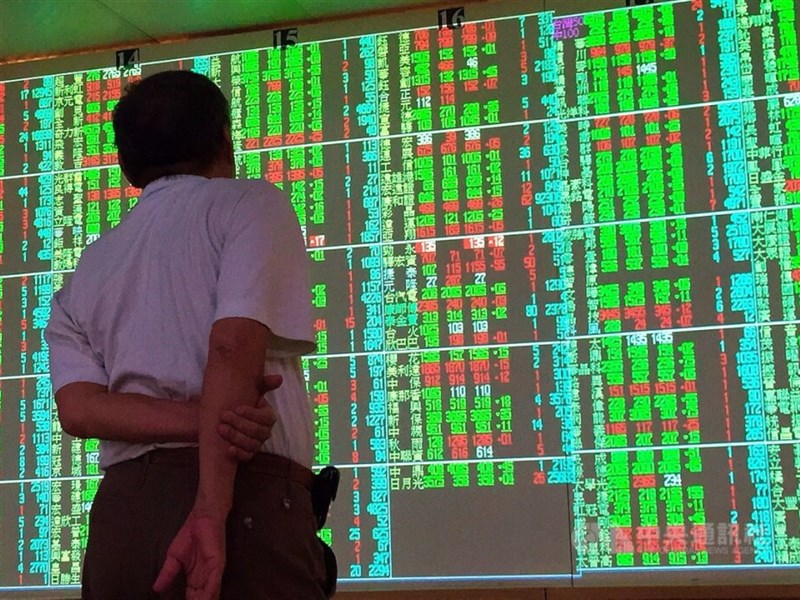

Taipei, Oct. 23 (CNA) Shares in Taiwan fell more than 1 percent Monday to reach their lowest level in five months after markets in the United States were hurt by a spike in Treasury yields, dealers said.

The bellwether electronics sector dragged prices lower, especially large cap stocks such as chipmaker Taiwan Semiconductor Manufacturing Co. (TSMC), as rising Treasury yields made tech stocks and their relatively low dividends less attractive, dealers said.

The Taiex, the Taiwan Stock Exchange’s weighted index, ended down 189.36 points, or 1.15 percent, at 16,251.36 after moving between 16,245.84 and 16,391.41. Turnover totaled NT$213.14 billion (US$6.59 billion).

Monday’s closing level was the lowest since May 24, when the Taiex ended at 16,159.32.

The market opened down 0.30 percent, and selling gained momentum after the Dow Jones Industrial Average fell 0.86 percent and the tech-heavy Nasdaq fell 1.53 percent on Friday, when the benchmark 10-year U.S. Treasury yield topped 5 percent at one point, dealers said.

TSMC, the most heavily weighted stock in Taiwan, tumbled 2.16 percent to close at NT$544.00.

Its losses contributed about 100 points alone to the Taiex’s fall and sent the electronics index and the semiconductor sub-index 1.56 percent and 2.05 percent lower, respectively.

“It was no surprise that rising Treasury yields led many investors to move off tech stocks,” MasterLink Securities analyst Tom Tang said.

“TSMC, which had posted gains in the previous two sessions amid optimism toward the fourth quarter and 2024, simply fell back as investors used the U.S. plunge as an excuse to take profits.”

Hon Hai Precision Industry Co., second to TSMC in terms of market value, came under heavy pressure, pushing down the broader market further on news that its subsidiaries in China are facing tax audits and a probe into land use.

Hon Hai, also known as Foxconn on the global markets and a major assembler of Apple Inc.’s iPhones, lost 2.90 percent to end at NT$100.50.

“Before the investigations into Hon Hai’s subsidiaries yield results, fears over further volatility in the company’s share price is likely to continue, leading investors to sell more of their holdings,” Tang said.

Among other semiconductor stocks, high-priced stocks had a tough time Monday.

Global Unichip Corp., TSMC’s application-specific integrated circuit (ASIC) design subsidiary, plunged 8.81 percent to close at NT$1,450.00, and Alchip Technologies, Ltd., another ASIC designer, lost 2.91 percent to end at NT$2,500.00.

“The silver lining was that select stocks related to artificial intelligence development appeared resilient after recent heavy losses,” Tang said. “Bargain hunters found a buying opportunity amid continued optimism toward AI applications.”

Among them, AI server maker Wistron Corp. rose 1.20 percent to close at NT$92.50, and Wiwynn Corp, Wistron’s cloud application subsidiary, ended unchanged at NT$1,515.00.

In addition, Inventec Corp, another AI server supplier. lost 0.46 percent to close at NT$43.45 but still outperformed the Taiex, while rival Quanta Computer Inc. lost 1.96 percent to end at NT$200.50.

Tang said old economy stocks largely moved lower in line with the Taiex. Among them, Formosa Plastics Corp. fell 0.64 percent to close at NT$78.10, and Nan Ya Plastics Corp. dropped 1.09 percent to end at NT$63.70.

Meanwhile, textile brand Far Eastern New Century Corp. lost 0.69 percent to close at NT$28.65, and Eclat Textile Co. ended down 0.56 percent at NT$529.00.

Amid a falling tech sector, some investors still sought stocks in the old economy sector as safe havens to park their money, and the tourism industry benefited, Tang said.

The tourism index rose 1.31 percent with Formosa International Hotels Corp. rising 2.37 percent to close at NT$194.50, Chateau International Development Co. gaining 1.69 percent to end at NT$42.00, and My Humble House Hospitality Management Consulting growing 1.14 percent to close at NT$35.60.

In addition, Wowprime, which owns a dozen restaurant brands in Taiwan, rose 4.16 percent to end at NT$238.00.

In the financial sector, which lost 0.86 percent, Cathay Financial Holding Co. lost 1.34 percent to close at NT$44.10, Fubon Financial Holding Co. dropped 1.32 percent to end at NT$59.90, and Mega Financial Holding Co. closed down 1.07 percent at NT$37.10.

“The ongoing earnings season in the U.S. is expected to continue to dictate the share prices of Taiwan’s tech stocks and is worth watching closely,” Tang said.

“More importantly, the military conflict between Israel and the militant group Hamas could move international crude oil prices higher and push already high inflation higher worldwide.”

According to the Taiwan Stock Exchange, foreign institutional investors sold a net NT$13.61 billion in shares on the market Monday.