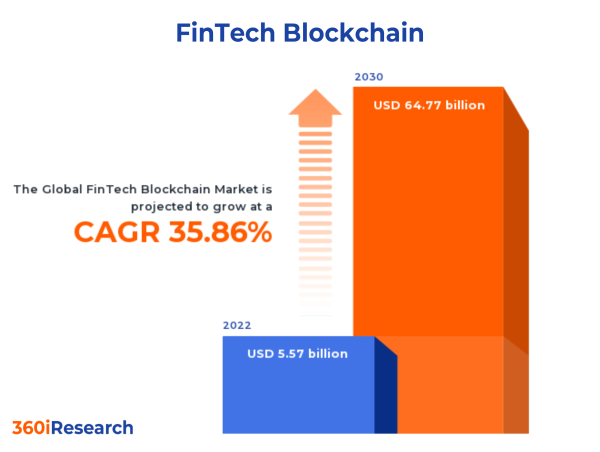

The Global FinTech Blockchain Market to grow from USD 5.57 billion in 2022 to USD 64.77 billion by 2030, at a CAGR of 35.86%. PUNE, MAHARASHTRA, INDIA , November 9, 2023 /EINPresswire.com/ — The “FinTech Blockchain Market by Provider (Application & Solution Providers, Infrastructure & Base Protocol Providers, Middleware & Service Providers), Organization Size (Large Enterprises, Small & Medium Enterprises), Application, Vertical – Global Forecast 2023-2030” report has been added to 360iResearch.com’s offering. The Global FinTech Blockchain Market to grow from USD 5.57 billion in 2022 to USD 64.77 billion by 2030, at a CAGR of 35.86%. Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/fintech-blockchain?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample Blockchain in FinTech is a decentralized and distributed digital ledger that securely records transactions across multiple computers in real-time, ensuring data integrity, transparency, and immutability. Blockchain technology in FinTech enables efficient processing and management of various financial operations such as cross-border payments, securities trading, and digital identity verification. It achieves this by eliminating intermediaries such as banks and clearinghouses, thereby streamlining processes, reducing costs, and enhancing security. Moreover, its decentralized nature allows for enhanced collaboration among participants through smart contracts as self-executing agreements with predefined rules encoded on the platform. The popularity and adoption of cryptocurrencies such as Bitcoin and Ethereum, along with the need for secure payment systems in the FinTech industry, has increased the adoption of blockchain solutions. However, uncertain regulatory standards and frameworks in various countries, along with security concerns, are restricting market growth. On the other hand, growing investments in FinTech and blockchain technology for technological advancement & integration of AI and ML in FinTech blockchain are expected to create lucrative growth prospects for the market in the upcoming years. Vertical: Wider application of blockchain technology by banking sector for automate their processes Banks leverage blockchain technology to improve services like cross-border payments, smart contracts for trade finance operations, syndicated loan management, and Know Your Customer (KYC) processes. Blockchain provides a decentralized ledger that enables faster and more transparent processing of transactions while reducing fraud and operational costs. Banks can automate loan disbursal and identity verification processes by employing smart contracts. Blockchain technology simplifies claim settlements by streamlining the authentication of documents and policyholders’ identities for the insurance sector. It promotes transparency in risk data sharing among insurers through peer-to-peer platforms. Furthermore, with improved fraud detection capabilities enabled by blockchain’s immutable ledger system, insurers can significantly lower operational costs. Non-banking financial services (NBFCs) also benefit from incorporating blockchain technology. Asset management firms can leverage it for real-time tracking of investments and secure transfer of ownership titles. Peer-to-peer lending platforms and crowdfunding portals can benefit from blockchain’s decentralized nature that eliminates intermediaries. It enhances transparency during fund transfers while offering a tamper-proof record of transactions. Moreover, the tokenization aspect of blockchain allows NBFS providers to access alternative funding sources through asset-backed tokens or initial coin offerings (ICOs). Provider: Expanding utilization by infrastructure & base protocol providers for building scalable and secure blockchain networks Application & solution providers develop specialized applications and end-to-end solutions catering to various FinTech industries such as banking, insurance, remittance, asset management, and capital markets. These providers utilize core blockchain features, including immutability, transparency, and decentralization, to streamline processes, reduce costs, and increase participant trust. Further applications & solutions provide smart contracts to automate transactions, decentralized applications (DApps) for improved security and transparency, and tokenized platforms for digitizing assets. Infrastructure & base protocol providers set the foundation for building scalable and secure blockchain networks that power diverse applications across FinTech industries. These infrastructure & base protocol providers develop core blockchain protocols such as Ethereum or custom private blockchains that ensure data integrity, consensus mechanisms for validating transactions, and cryptographic techniques for securing network communications. These providers address key challenges such as scalability, interoperability between different networks, and privacy concerns while offering features such as consensus algorithms and encryption mechanisms that ensure secure data transmission and storage. It also provides tools that enable developers to easily create applications using pre-built templates or software development kits (SDKs). Middleware & service providers bridge the gap between base protocols and applications by offering tools, libraries, APIs, oracles, and other services that enable developers to build feature-rich applications with ease and further simplify the process of integrating existing systems with blockchain infrastructure while maintaining high standards of security and performance. Middleware providers facilitate seamless integration of various FinTech blockchain elements, while service providers help businesses optimize their processes through analytics platforms or consulting services that aid in navigating complex regulatory environments. Service providers offer value-added services like multi-signature wallets for enhanced security management, identity verification solutions for regulatory compliance (KYC/AML), data storage options such as decentralized file systems, and oracles for accessing off-chain data sources within smart contracts. Application: Growing use of blockchain technology for payment, clearing & settlement application The adoption of blockchain for KYC processes has increased efficiency in financial institutions & organizations. Customer data can be stored in a secure digital identity with blockchain solutions, eliminating the need for paper-based documents and manual data entry. This can streamline the onboarding process, reducing the time and cost associated with traditional KYC processes. Blockchain’s distributed ledger system enhances compliance management by streamlining KYC procedures and enabling secure data sharing between institutions. This reduces duplication and minimizes operational risks and costs associated with manual data verification. Incorporating blockchain in a cross-border payment system facilitates a reduction in transaction times, enhanced transparency, and traceability. Blockchain-based cross-border payments can enable secure transfers between an infinite number of bank ledgers, bypassing banking intermediaries that serve as middlemen to help transfer money from one bank to another. Exchanges and remittance services also benefit from blockchain technology by introducing peer-to-peer trading platforms that allow for secure, low-cost transactions across borders. Blockchain-based exchanges & remittance services use distributed ledger technology to enable individuals and organizations to send and receive money directly without intermediaries. Blockchain-based identity management systems offer unparalleled benefits such as transparency, traceability, and tamper-proof records. These systems enable self-sovereign identities where users can create, manage, and share their digital identities without intermediaries. Smart contracts are another vital aspect of FinTech, where blockchain plays a significant role. These self-executing agreements contain predefined rules agreed upon by involved parties and automatically execute transactions once certain conditions are met. Smart contracts on blockchain platforms ensure trustworthiness, reduce fraud risks, and eliminate the need for middlemen or traditional intermediaries such as banks or legal firms. Organization Size: growing adoption by large enterprises for faster transaction processing Blockchain solutions are beneficial for both large enterprises and small & medium-sized enterprises (SMEs) in the FinTech sector by providing a decentralized, transparent, and secure digital ledger system, resulting in improved efficiency, reduced costs, and mitigated risks in numerous FinTech applications. For large enterprises, blockchain enables faster transaction processing by eliminating intermediaries and automating processes through smart contracts. With Distributed Ledger Technology (DLT) applications, large organizations can securely share data with their partners and clients while maintaining privacy. The adoption of blockchain technology has positioned small & medium enterprises (SMEs) competitively within the market. SMEs leverage the enhanced security provided by blockchain for Know Your Customer (KYC) compliance processes, allowing them to streamline customer onboarding while reducing fraud risks. Furthermore, cross-border payment solutions powered by blockchain technology offer small & medium businesses global reach with reduced transaction fees and real-time settlements. Regional Insights: In the Americas, well-established financial hubs and the increasing use of cryptocurrency raised the utilization of FinTech blockchain technology. FinTech companies in the United States, Canada, Brazil, and Mexico focus on employing blockchain technology to eliminate the need for third-party intermediaries in financial operations. The United States, Mexico, Canada, Brazil, and Argentina governments support responsible digitalization of financial institutes and blockchain integration in financial processes to expand access to safe financial services. In Asia-Pacific, rapidly rising digital transactions, government initiatives and investment in blockchain technology, and advancement in FinTech blockchain technology significantly increased the utilization of FinTech blockchain technology. Countries, including Singapore and Hong Kong, have established global financial centers by embracing digital transformation initiatives. Traditional finance institutions are partnering with emerging tech firms to leverage their expertise in blockchain implementation for streamlining processes such as cross-border payment transactions across the region. The adoption of FinTech blockchain technology in the EMEA region has experienced significant growth, owing to the increasing regulatory support, collaboration between banks and blockchain startups, and rising demand for enhanced financial services. The European Union (EU) implemented the revised Payment Services Directive (PSD2), which encourages innovation in financial services by opening up banking data to third parties through application programming interfaces (APIs). FPNV Positioning Matrix: The FPNV Positioning Matrix is essential for assessing the FinTech Blockchain Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V). Market Share Analysis: The Market Share Analysis offers an insightful look at the current state of vendors in the FinTech Blockchain Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied. Key Company Profiles: The report delves into recent significant developments in the FinTech Blockchain Market, highlighting leading vendors and their innovative profiles. These include Accenture PLC, AlphaPoint, Amazon Web Services, Inc., Anchorage Digital, Applied Blockchain Ltd., Auxesis Group, Bitfury Group Limited, BitGo Holdings, Inc., BitPay, Inc., Blockchain.com, Inc., Chain Global Ltd., Chainalysis Inc., Circle Internet Financial, LLC, Coinbase Global, Inc., Consensys Software Inc., Digital Asset Holdings, LLC, Factom, Gemini Trust Company, LLC, GuardTime OÜ,, International Business Machines Corporation, JPMorgan Chase & Co., Kraken by Payward, Inc., Microsoft Corporation, Morgan Stanley, Oracle Corporation, R3 HoldCo LLC, Ripple Labs Inc., Stellar Development Foundation, Tata Consultancy Services, and Wipro. Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/fintech-blockchain?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire Market Segmentation & Coverage: This research report categorizes the FinTech Blockchain Market in order to forecast the revenues and analyze trends in each of following sub-markets: Based on Provider, market is studied across Application & Solution Providers, Infrastructure & Base Protocol Providers, and Middleware & Service Providers. The Infrastructure & Base Protocol Providers commanded largest market share of 45.54% in 2022, followed by Application & Solution Providers. Based on Organization Size, market is studied across Large Enterprises and Small & Medium Enterprises. The Large Enterprises commanded largest market share of 78.66% in 2022, followed by Small & Medium Enterprises. Based on Application, market is studied across Compliance Management & Know Your Customers, Cross-Border Payment and Exchanges & Remittance, Identity Management, Payment, Clearing & Settlement, and Smart Contract. The Payment, Clearing & Settlement commanded largest market share of 33.98% in 2022, followed by Cross-Border Payment and Exchanges & Remittance. Based on Vertical, market is studied across Banking, Insurance, and Non-Banking Financial Services. The Banking commanded largest market share of 58.20% in 2022, followed by Non-Banking Financial Services. Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 40.72% in 2022, followed by Europe, Middle East & Africa. Key Topics Covered: 1. Preface 2. Research Methodology 3. Executive Summary 4. Market Overview 5. Market Insights 6. FinTech Blockchain Market, by Provider 7. FinTech Blockchain Market, by Organization Size 8. FinTech Blockchain Market, by Application 9. FinTech Blockchain Market, by Vertical 10. Americas FinTech Blockchain Market 11. Asia-Pacific FinTech Blockchain Market 12. Europe, Middle East & Africa FinTech Blockchain Market 13. Competitive Landscape 14. Competitive Portfolio 15. Appendix The report provides insights on the following pointers: 1. Market Penetration: Provides comprehensive information on the market offered by the key players 2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets 3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments 4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players 5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments The report answers questions such as: 1. What is the market size and forecast of the FinTech Blockchain Market? 2. Which are the products/segments/applications/areas to invest in over the forecast period in the FinTech Blockchain Market? 3. What is the competitive strategic window for opportunities in the FinTech Blockchain Market? 4. What are the technology trends and regulatory frameworks in the FinTech Blockchain Market? 5. What is the market share of the leading vendors in the FinTech Blockchain Market? 6. What modes and strategic moves are considered suitable for entering the FinTech Blockchain Market? Read More @ https://www.360iresearch.com/library/intelligence/fintech-blockchain?utm_source=einpresswire&utm_medium=referral&utm_campaign=analystMr. Ketan Rohom 360iResearch +1 530-264-8485 [email protected]