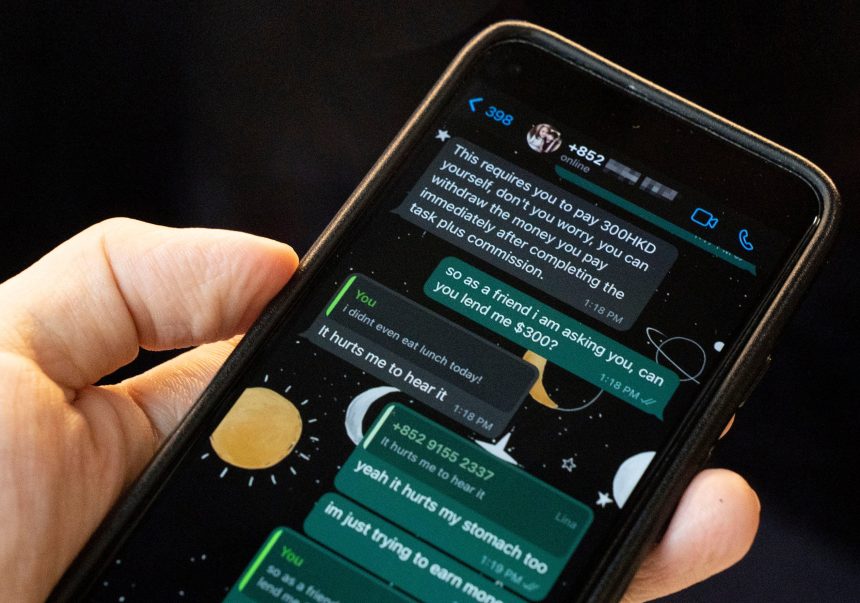

The number of online investment scams reported in Hong Kong surged to an all-time high in the first nine months of 2023, with losses from more than 3,500 cases hitting HK$2.1 billion. Police warned residents of a rise in sham chat groups where scammers impersonated stock commentators or celebrities to lure victims onto bogus investment platforms. “Victims usually get some returns at first, but once they wish to withdraw money after pouring in large sums, the scammer will ask for exorbitant fees or claim the platform is out of service, with the victim incurring huge losses,” Superintendent Baron Chan Shun-ching of the force’s cybersecurity and technology crime bureau said. Reports to police of online investment scam cases in the first nine months of the year jumped 168 per cent to 3,523 compared with 1,315 in the same period last year. Losses rose 225 per cent from HK$656 million in the first nine months of 2022 to HK$2.1 billion this year. Police made 4,190 arrests in connection with such scams over the past nine months and reported more than 6,860 suspicious pages and accounts to internet service providers for removal or blocking. Hongkongers warned to watch out for hacked WhatsApp accounts after cases surge Sixty per cent of the reported cases in the first nine months took place on WhatsApp, with 20 per cent on Facebook and 11 per cent on other platforms, including dating apps. More than half of the victims had invested in local and overseas securities, while 30 per cent had invested in cryptocurrencies. Chan said online fraudsters had changed tactics over the years, moving from romance scams that took them longer to build relationships with victims, to investment traps where they could scam people more quickly. Among the victims was a clerk in her 40s who lost almost HK$500,000 over three months after joining a Facebook chat group in August that claimed to offer investment tips from famous stock commentators . The woman, a novice investor surnamed Chan, said she had initially lost some money with the tips. But she was persuaded to join an investment scheme called the “688 per cent winning plan”, which promised returns of 3 to 14 per cent, ultimately losing HK$490,000 over nine transactions as she desperately tried to recoup past losses. “I was definitely affected by my emotions. But one of the commentators surnamed Lam appeared on camera offering tips and would also make posts warning us not to believe other websites recommending A-shares or mainland stocks,” Chan recalled. Hong Kong woman, 80, duped out HK$9.1 million; more than 200 arrested in crackdown The cybersecurity bureau’s Senior Inspector Tyler Chan Chi-wing said it was common for fraudsters to place advertisements to promote their sham investment groups and websites, while using images of celebrities or offering extremely high returns to lure members to their groups. He urged residents to search the account records of investment groups under the Page Transparency section on any Facebook page to check their legitimacy. Information such as the date of establishment, location of administrators, number of posts, advertisement records and whether there was official blue-check verification would help users identify suspicious sites. Chan said red flags included recent establishment dates, records of irrelevant posts and administrators from overseas posing as local celebrities. As for online chat groups, the senior inspector urged residents to look out for duplicated profile pictures in members’ lists, comments unanimously extolling a particular commentator, links to download unknown investment platforms and be wary of videos featuring celebrities. Michelle Yeung Wai-yee of the Hong Kong Investor and Financial Education Council urged residents to learn about investment products from multiple sources before making any decision. “In the past, if we had to conduct transactions, we had to go to the bank. It was a time-consuming process, but that gave investors time to think twice about their investment,” said Yeung, head of investor and financial education at the council. “I hope to remind everyone that decisions don’t have to be made so soon, we can stop and think about whether we should make such a decision.” The number of online investment scams in the first three quarters exceeded the annual total for 2022, as well as over the past four years. The force handled 1,884 cases in 2022, 980 in 2021 and 544 in 2020.