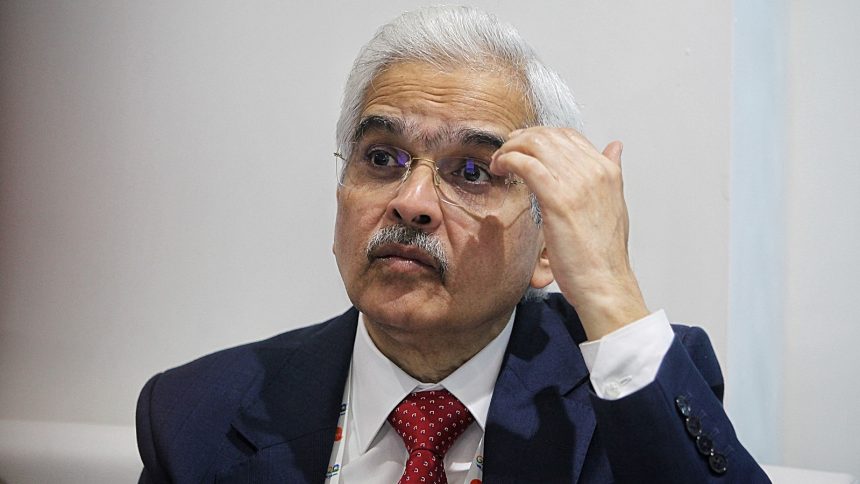

Amid geopolitical tensions, India’s growth momentum remains strong and the second-quarter gross domestic product (GDP) growth number is expected to surprise on the upside, Reserve Bank of India Governor Shaktikanta Das said Tuesday. The GDP growth figure for July-September quarter will be released November 30 by the National Statistical Office (NSO). GDP growth rose to a four-quarter high of 7.8 per cent in April-June. “Growth momentum in India continues to be strong. Looking at the momentum of economic activity and looking at a few early data points which have come, I can say that the second quarter GDP number, as and when it is released at the end of November, in all probability, will surprise everyone on the upside,” Das said while speaking at a BFSI summit organised by Business Standard. For fiscal 2024, the RBI has projected the GDP growth at 6.5 per cent, with Q2 at 6.5 per cent. According to Das, the biggest challenge to every country is the evolving geopolitics and its fallout on financial markets and global growth. Economists have raised worries over the escalating Israel-Hamas conflict, as it could hurt global growth and push energy prices up. “New flashpoints are developing and new geopolitical conflict points are developing. So, geopolitics, I think, today poses the biggest risk for growth not just for India, but for the world as a whole,” the governor said. He said when the Russia-Ukraine war began, it immediately led to the financial market volatility and also, to some extent, pulled down global growth. “So far as India is concerned, even with all geopolitical risks, I can say with confidence that India is better placed compared to other countries to deal with such risky or such potentially risky situations,” Das said. On India’s inclusion in the JP Morgan GBI-EM Global index, Das said the move is a kind of a “vote of confidence about the Indian economy and the Indian financial market”. The RBI governor, however, said the index inclusion is a double-edged sword — it leads to inflows but passive funds can pull out money if the weightage goes down. Das assured that the RBI has a track record of handling large scale inflows and outflows. “Last year, after the Ukraine war started, we did not see the kind of outflows which were there after the taper tantrum. In terms of market sentiment, I think the overseas investors have greater confidence in the RBI’s ability to service the outflow of currency. There was never a doubt that the RBI will not be able to meet the dollar requirement, and it was because of the (foreign exchange) reserves which we had built up,” he said. Similarly, in 2020 and 2021, when liquidity was easy all over the world, there were large scale inflows and that opportunity was utilised by the RBI to build up forex reserves. On cryptocurrency, the RBI governor said that it is a very serious threat to financial stability for all countries, especially for emerging market economies. “It (cryptocurrency) is a serious financial stability risk. It has to be dealt with properly,” he said. The governor said the risks around crypto assets are well recognised by the International Monetary Fund (IMF) and the Financial Stability Board (FSB) synthesis paper and the Bank of International Settlements’ (BIS) paper on cryptocurrencies. In September this year, IMF and FSB prepared a policy paper, at the request of the Indian G20 Presidency. While raising concerns around the potential impact of cryptocurrencies on nations’ monetary policies, the paper suggested licensing crypto service providers and called for countries to implement the Financial Action Task Force (FATF) anti-money laundering and counter-terrorist financing (AML/CFT) standards in the sector. The policy paper, however, suggested that an outright ban might not work given the borderless nature of cryptocurrencies. Earlier this month, the finance ministers of the G20 nations had called for swift and coordinated implementation of the G20 roadmap to deal with the issues related to the crypto assets, a communique issued during the fourth meeting of the G20 Finance Ministers and Central Bank Governors (FMCBG) under the Indian Presidency in Marrakech, Morocco. Speaking on the internationalisation of rupee, Das said it is not a target and is a process. He said there is a phased road towards greater internationalisation of the rupee and the RBI does not have any particular timeline for it. “For a moment, let me stress that we are not pitting the rupee against the dollar. It’s not a question of rupee versus the dollar. The dollar is the dominant currency and will perhaps remain the dominant currency for international trade for years to come. But what we are looking at is to increase the footprint of the Indian rupee in international trade, especially with regard to countries with which India has very close and active trade relations,” the governor said. In July this year, a RBI-appointed inter-departmental group (IDG) gave a few short to long term measures to accelerate the pace of internationalisation of the rupee. Das noted that the Indian banking and NBFC sectors, at the moment, are healthy and robust. Speaking on the attrition in private banks, Das said the RBI, as a part of its supervision, is looking into the rate of attrition, which is seen to be high in certain private sector lenders. “We have asked them (private banks) to look at it (higher attrition). Every bank, at the end of the day, has to build up its core team, which should really grow with the bank over the years,” he said. The governor’s comments come as certain private sector banks have witnessed a rise in attrition.